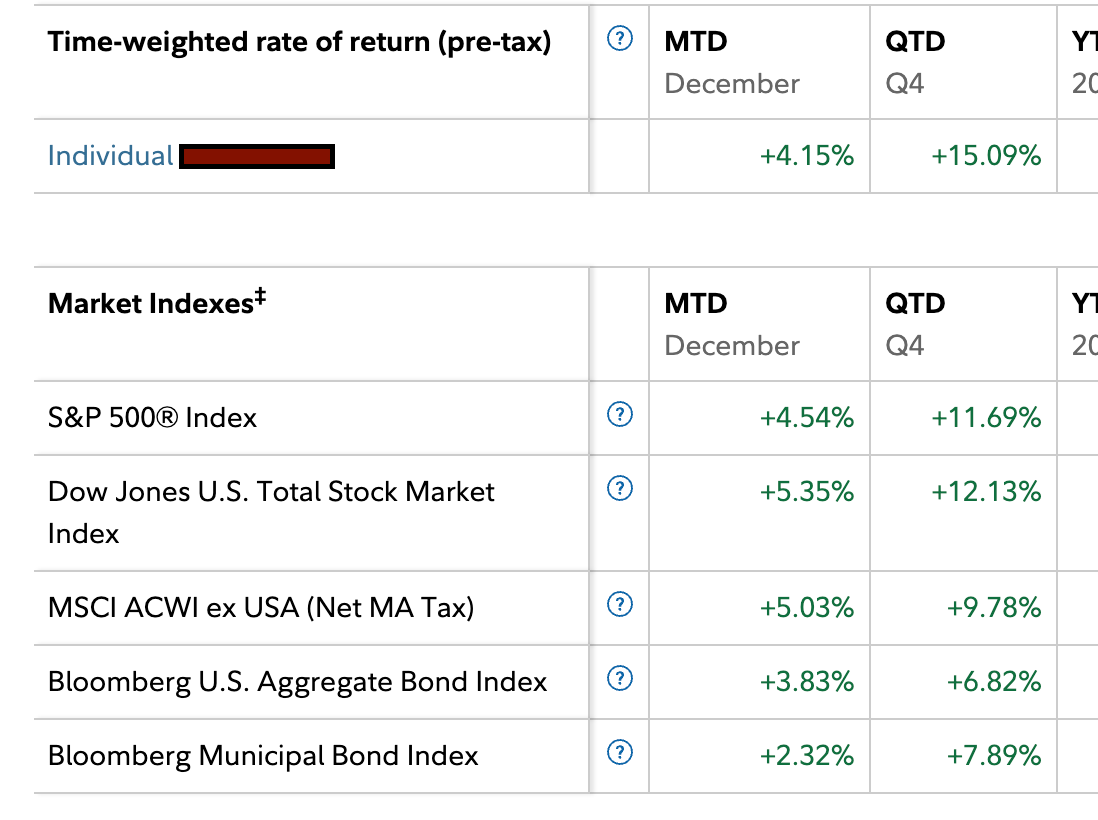

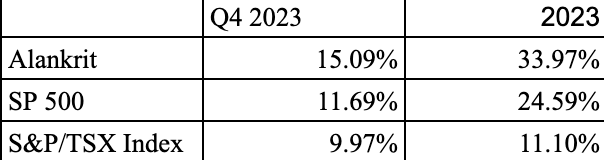

The fourth quarter of 2023 returned 15.09% for the portfolio, an outperformance of 3.4% when compared to the main benchmark, SPY 0.00%↑.

The full return for 2023 is 33.97% versus 24.59% which the SP500 has returned. This is an outperformance of 9.38% for the calendar year. Given that 80% of the portfolio is Canadian companies, I thought it was worth including the S&P/TSX Index as a comparison also.

As a reminder the full portfolio leading into 2024 can be viewed here.

2024 Moves

The past month I have been buying shares of Sygnity SA ( $SGN.WA ).I plan on continuing this. Even with the rapid price increase, I view it as extremely compelling. I’m (slowly) creating a write-up on the company. But in short, there are a lot of reasons to call it a retail investor's “dream”.

Doing research on that led me to find another company based in Australia which could be a good investment. That I still need to take a closer look at though.

A strategy with crypto/nfts was to follow the smart money. This is kind of like that, but the smart money is the Constellation Software family.

This document is intended for informational purposes. Past performance does not dictate future performance. Nothing is financial advice.