2024 Outlook | Macro | Holdings | Thoughts |

A look into the portfolio heading into 2024 and more

Hello!

I thought this would be a good time to share the portfolio leading up to 2024 and offer a few thoughts of my own.

Interest Rates / Macro

In late October I wrote out my macro thesis for 2024. Attached is a snippet.

Higher rates tend to mean high-yield stocks ( offering more income-wise over growth) are going to struggle. This can easily be visualized by taking a look at some REITS or other high-yield companies.

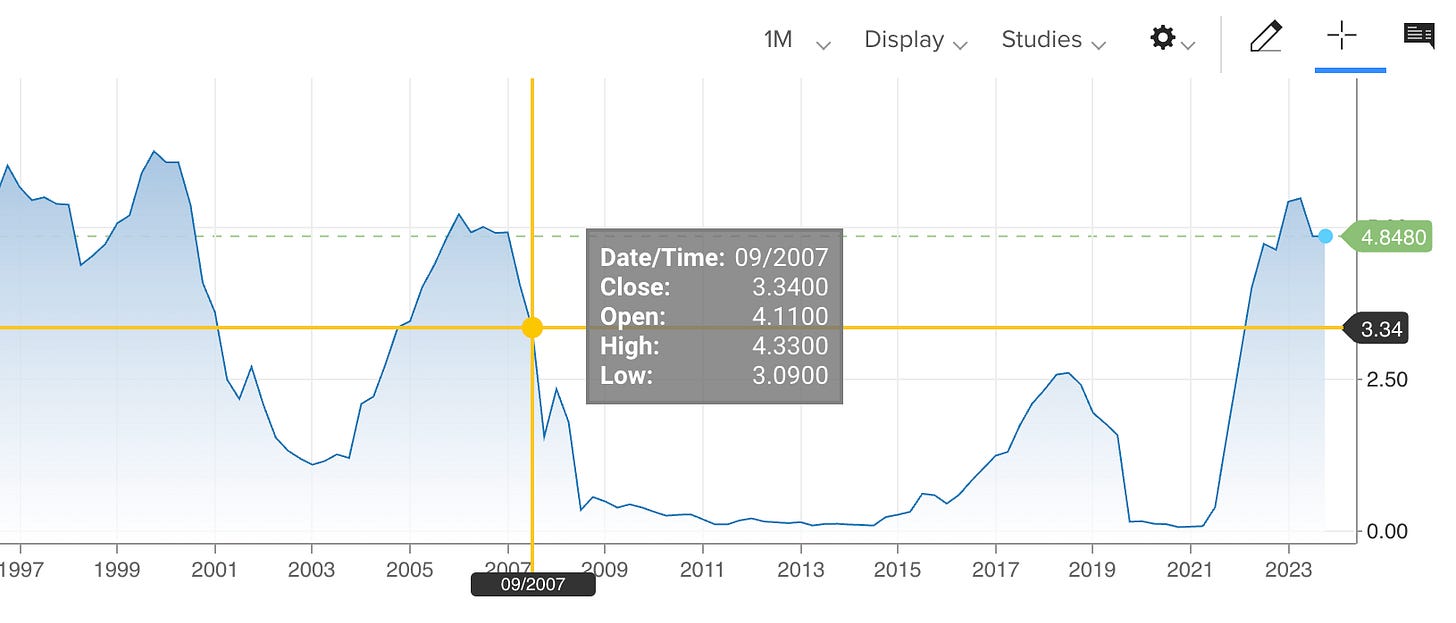

Here is the US One Year Treasury for the past five years. Until recently, if you were seeking income - high yield stocks were very attractive. But now, there is a risk-free 4.8% return. Risk-free is obviously more attractive than some risk, and thus, a leading reason as to why, a lot of companies are underperforming the tech-heavy SP500.

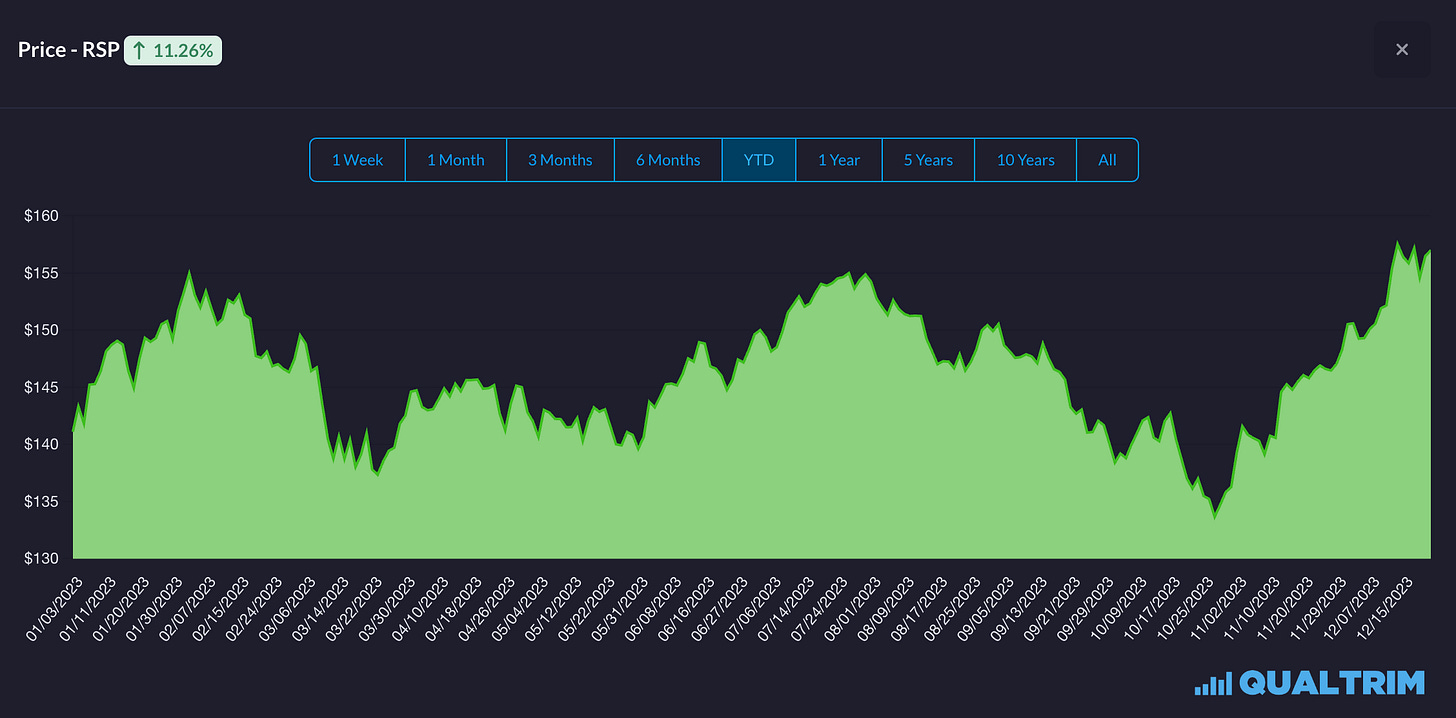

I think it's worth looking at the performance for RSP 0.00%↑ (equal weight SP500 fund) It's up 11.26% YTD (11.32% return the last three months) compared to the 24.37% that the normal SP 500 has returned.

The best part of the return - has happened as rates started to drop. Which essentially indicates how stocks would/should perform based on rates.

In fact, let's take a closer look at rates.

Here are the one-year treasury notes, but showing scrolled back a bit. The last time rates were around this level was in 2007! So much has changed since then. The iPhone was just released. Bush was still president. And I was two.

What does this all mean?

The predicted environment will still favor companies with predictable, high cash flows, stellar balance sheets, and those that have price empowerment.

Quality needs to be owned.

With rates coming down, RSP should do slightly better in 2024 ( I’d be shocked if it outperformed the normal SP500 index though)

Index Statistics

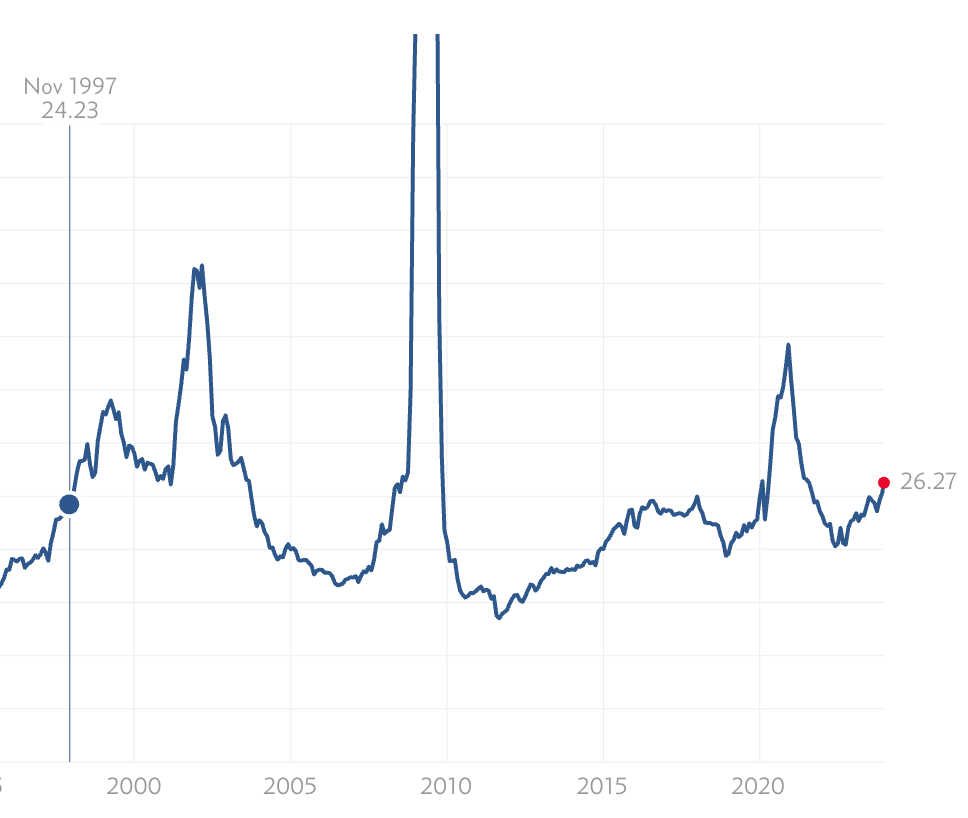

I created a screen of all SP500 companies with a forward PE over 1 using Capital IQ, downloaded the file to Excel, and found that the average PE ratio was 23.

On average the index is not “cheap” from a P/E ratio. However, I don’t think this is “insane”?

1Here is a chart I found. I don’t have any overall opinion on the 23 PE average, but knowing that over 60% of my portfolio has a multiple under this, is nice.

Possibly good buys?

Two stocks that have underperformed this year(s), and I find interesting right now areAMT 0.00%↑ and BTI 0.00%↑ .

BTI generates a lot of cash. It trades at a forward PE of 6. Which is cheap. PM has a similar valuation but also has a payout ratio of 99% versus BTI’s 45%. But, the industry has a lot of troubles. Smoking is on the decline. Still, price hikes have allowed these companies to continue making a lot of money. Vapes are an issue, especially with the FDA not doing enough ( in my opinion at least) to combat illegal Chinese vapes such as Elf Bars and more.

Paying down their debt would be an excellent way for the company to become more attractive. At this time I am not comfortable with buying into it.

My parents have certainly noticed that I have been researching this area for the past few months though! Excited to go through this awesome Christmas gift.

AMT, on the other hand, has a compelling thesis for future growth. The shares are arguably cheap, and when they reduce their leverage, the “machine” should get going again.

Here is a page of notes compiled based on the recent Akre meeting. I thought they were interesting. Someone on Twitter made a document with the transcript, and I made notes of some of it. Can’t remember who it was - but thanks.

I quite like the AMT thesis, but right now it is not attractive enough to buy for me.

The Portfolio

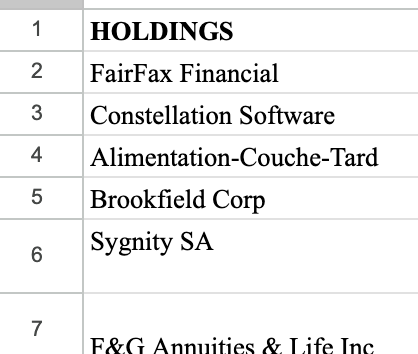

I run a highly concentrated portfolio. I seek growth over income. Quality first. Until a thesis changes or a better opportunity comes out, I don’t see a reason to sell out of a position. I run my own capital, so the time horizon is long. My capital has been built up from trading crypto, NFTs, and selling cards ( soccer). I don’t love massive drawdowns, but all of these positions have significant upside, and think they will continue to do well.

High rates? Fairfax reduced bond duration when rates were low and locked into very attractive yields when they were higher.

Recently, in October, during spike in treasury yields, we have extended our duration to 3.1 years with an average maturity of approximately 4 years, and yield of 4.9%

Couche-Tard trades at a P/E below its peers, and has a very good growth plan over the next five years. Their track record is amazing. The American convenience store industry is very fragmented, leading them to have lots of room to continue to grow.

I can’t say, I’ve always felt comfortable with the valuation of Constellation Software but they execute their deals flawlessly, and are organized so well. I like how the business units operate. And I’m a big fan of the spin-offs as a way to unlock further value. Vertical markets are cool because prices can steadily go up, while no one switches over due to the cost.

The relationship between Constellation and Sygnity is fascinating to take a look at. Would highly recommend everyone look closer at it.

On the topic of the Constellation family, I have been considering rebuying into the Lumine Group. Selling was a mistake.

Let's reflect to what I wrote above: “ Vertical markets are cool because prices can steadily go up, while no one switches over due to the cost.” Now imagine the telecom/radio market. I’m not sure how much more I want to allocate to tech though. Will be something to think about.

Here are some notes on the constellation family. Once again they have mostly been made from past articles/commentary that I have read.

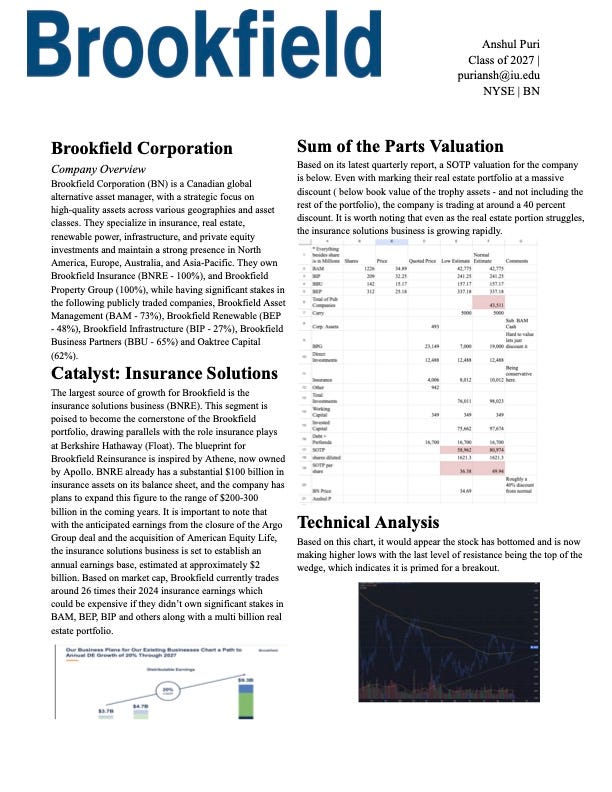

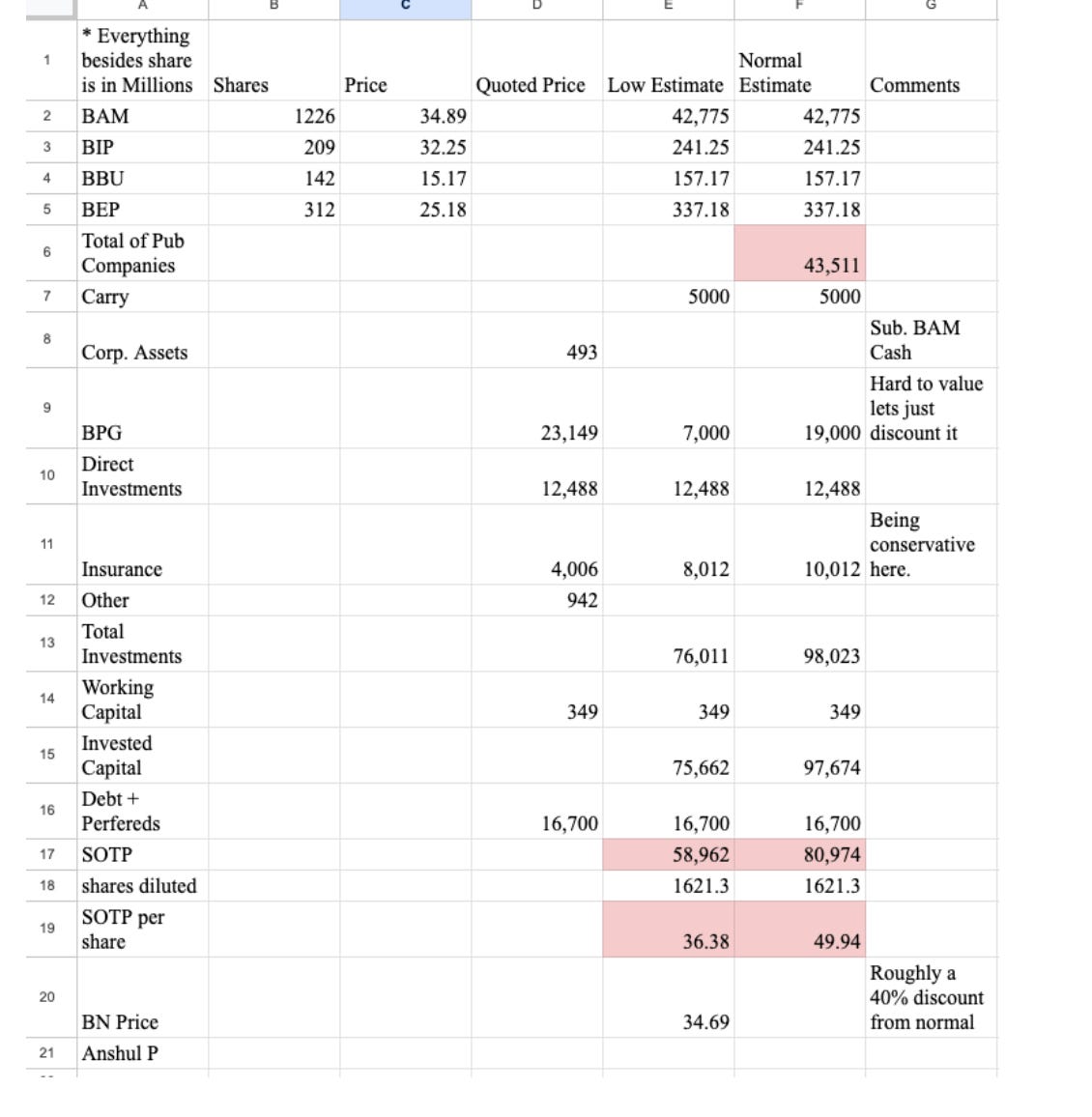

Brookfield Corp is a holding company, with stakes in numerous publicly traded subsidiaries/partnerships, a large real estate portfolio, and a growing insurance business. I bought a lot in early Jan, and March. Trimmed a bit of the position a few months ago. The recent rally in the past six months has been great as a shareholder. I’m going to attach a write-up I did for a club a few months ago. Lots of the numbers are out of date.

I wrote about FG recently. Feel free to read about it here.

Full portfolio as of 12/25/23

As always, thank you for reading my post. I appreciate every reader. I hope everyone has a good conclusion to their year, and a great 2024.

This document is intended for informational purposes. Past performance does not dictate future performance. Nothing is financial advice.

https://www.multpl.com/s-p-500-pe-ratio