Disc: Long BELFB 0.00%↑

This is part one of a two-part series on Bel Fuse. This short post focuses on their transformative acquisition of Enercon1. Early next year, a full report on the company, including a detailed model, will be released.

Bel Fuse2 is acquiring Enercon Technologies, a defense company, at a 10.4x EV/EBITDA multiple. Enercon produces proprietary parts with 45% gross margins and 34% EBITDA margins, and it has grown 25% over the last twelve months (LTM).

The deal involves Bel acquiring 80% of Enercon from Fortissimo Capital immediately, with the remaining 20% to be purchased by early 2027. Enercon will contribute approximately 18% of Bel's combined revenue and drive a 40% increase in EBITDA. This acquisition strengthens Bel’s position in the aerospace and defense sectors, reinforcing their growth trajectory.

This isn’t just a margin play, CFO Farouq Tuweiq is driving this acquisition, signaling confidence in the company’s strategic direction. The biggest concern was that Daniel Bernstein (the founder’s son) might steer the company back toward its old ways, but this deal reflects sound decision-making and discipline.

Enercon wasn’t bought at a bargain, but its quality justifies the price. The acquisition reduces cyclicality, strengthens aerospace and defense exposure, and lowers Bel’s reliance on China.

Most importantly, this positions Bel Fuse closer to companies like Amphenol, which trades at 20x 2025 EV/EBITDA.

Enercon’s sales are geographically split as follows:

50% North America

40% Israel

10% Rest of the World (RoW)

Enercon provides specialized power and networking equipment essential for keeping military systems operational in harsh environments. Their products are critical for tanks, planes, ships, and radar systems.

From a product mix perspective, Enercon operates in three main categories:

Power Solutions

These components take energy from a source—like a battery or generator—and convert it into a usable form for equipment like radios, computers, or radar systems.

Power Management Systems

Acting as smart energy managers, these systems distribute power efficiently while protecting equipment from damage caused by overloads, spikes, or power interruptions. They also monitor energy usage in real-time to ensure systems stay operational, minimizing downtime.

Networking Solutions

These products connect devices—like sensors, communication systems, and computers—allowing seamless data and communication sharing. This connectivity ensures effective coordination, critical for military operations.

With this acquisition, Aerospace & Defense becomes Bel Fuse's largest end market, now representing 31% of LTM sales. I estimate the combined entity will generate approximately $150M in EBITDA for FY25.

Enercon’s 45% gross and 34% EBITDA margins are significantly higher than Bel Fuse’s current 38% gross and 18% EBITDA margins. This acquisition not only expands market share but also improves overall profitability and operating leverage.

I believe this acquisition is highly accretive and will drive significant growth for Bel Fuse in the coming years. Beyond enhancing profitability, the deal creates a clear path for future multiple expansion.

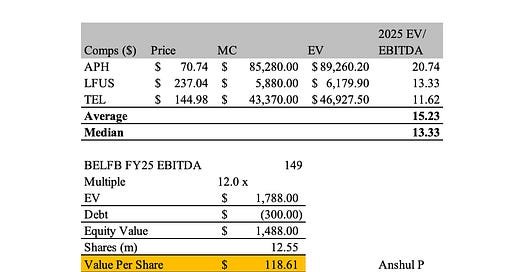

Based on comps and my estimates, I value Bel at about $118 per share.

This document is provided for informational purposes only. Past performance is not indicative of future results. This should not be considered financial advice. The author holds shares in the company mentioned above.

Thank you “Yerd” for the help.

https://enercon.co.il/

https://d7a3216312da6f8c5faa-a6c4a22c6d23d8694e5e3f94c3d57dde.ssl.cf2.rackcdn.com/8aecc8302e1311e8a82679698428dcab_CorporateHistoryNet-BelFuseBooklet-final.pdf