“ Since you are all quite familiar with Constellation and TSS … we will have a very similar approach”

Maciej Różycki, CEO Sygnity

Sygnity SA, a Polish company, operates within the Constellation Software network, specifically under the umbrella of Total Specific Solutions (TSS), which in turn is predominantly owned by Topicus, a Constellation Software company. SA stands for Spółka Akcyjna which is a type of public limited company in Poland, ( think corporation in the United States).

Sygnity is a software business that does software development, integration, and IT consulting, and is structured into four distinct business units: Public, Financial Services, Energy and Utilities, and Business Solutions. TSS bought the company to use as a vehicle for acquiring Vertical Market Software (VMS) companies in Poland.

TSS and Constellation favor VMS companies because they are defined by the capacity to generate stable and consistent cash flows, benefiting from a focus on specialized, niche markets that demand mission-critical solutions. The unique 'niche-centric' nature of VMS fosters a "stickiness" — these solutions become embedded in the core operations of users, leading to high customer retention and low churn due to the significant barriers to entry for competitors. Sygnity, with its history of single-digit revenue growth, has leveraged this model to maintain healthy EBITDA and FCF margins, of around 20%. Furthermore, since true VMS solutions are platforms that can be sold to multiple companies within a niche, VMS companies can leverage their IP (application) by implementing them repeatedly in different clients in the vertical niche.

While TSS intends to use Sygnity to acquire Polish VMS enterprises, Sygnity today is not a true VMS. Its current business consists of 25% undifferentiated IT services/integration and 75% customized IP development. While the latter ensures that Syngity has assets (unlike undifferentiated IT services), these software assets are not true VMS, because they are customized solutions applicable to only one client. So, while Sygnity enjoys stickiness and ongoing revenue from support and add-on development, it cannot leverage these assets the way a true VMS could, by selling it to multiple clients. Thus, if Sygnity acquires a new client, they have to expend money and labor to develop a new solution

As a consequence of Sygnity not yet following a VMS portfolio mode, it is a bit harder to compare the percentage of Sygnity’s revenue that is derived from maintenance and recurring revenue, which serves as a barometer for customer loyalty and satisfaction, with that of TSS / Constellation Software. The latter two appear to have a higher proportion of recurring revenue (underscoring the strength and sustainability of the business model), but much of the difference is because, since Sygnity produces highly customized one-to-one software solutions, a lot of maintenance work is recorded as “development”, while TSS / Constellation Software (which produces reusable one-to-many solutions) can do a lot of maintenance independent from development initiatives. This ability to reuse software without new development efforts underscore the advantage of leveraging software assets.

There are a multitude of reasons that make this a very compelling investment:

Ownership & Strategic Shift

Sygnity S.A.'s acquisition by Topicus has brought significant changes to the company, most notably in its leadership and ownership structure. The appointment of Maciej Różycki, formerly a portfolio manager at TSS Europe, as the new CEO, marks a strategic shift in leadership. The supervisory board has been bolstered with key figures from the TSS ecosystem, including Ivo van den Heuvel, General Manager of TSS Eastern Europe, Ramon Zanders, CEO of TSS and Director at Topicus, Ioana Corutiu, CFO at TSS, and Lucas de Ponte, Director of the Legal Department at TSS Europe with experience in M&A.

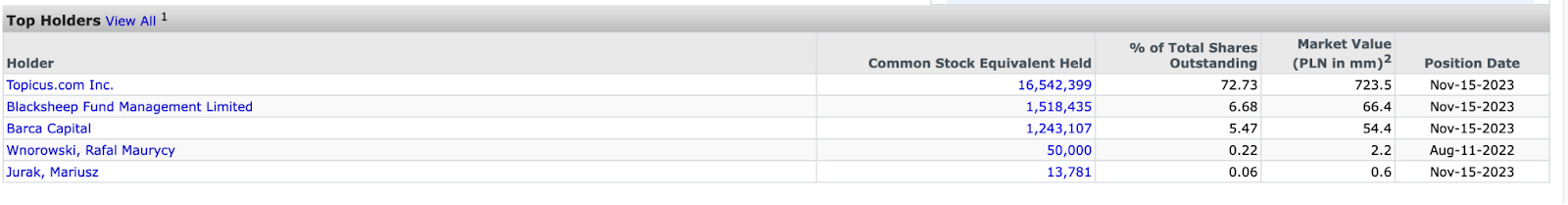

This is a chart of ownership from Capital IQ.

While CJ (@CJ0pp3l on Twitter) has this chart:

A notable shareholder here is Pinetree Capital, led by Damien Leonard, son of Mark Leonard, the founder of Constellation.

What stands out about Sygnity is the notably low public float, approximately 10% of the company. The reason for this is because TSS would like to own as much as possible of Sygnity, but feel that having Sygnity as a publicly-traded company on the Polish stock market will make owners of targeted software companies more comfortable with being acquired.

With a market cap of around 960 million PLN, equivalent to about 229 million USD, the availability of shares for trading is limited. The average daily trading volume of 3,000 shares, translating to about $33,000 in value, is not that much. This presents a unique opportunity for retail investors. The limited float means larger funds might find it challenging to invest in Sygnity without significantly impacting the share price, leaving a potential gap.

The recent acquisition of Edrana Baltic by Sygnity marks a turning point, underscoring the company's potential attractiveness to investors. This acquisition, while not large in scale, is pivotal as it signals Sygnity's strategic intent to acquire quality VMS companies. Edrana Baltic, a Lithuanian enterprise specializing in enterprise resource planning (ERP) software, represents the kind of targeted, niche acquisitions that align with Sygnity's broader objectives.

This is a clear indication that Sygnity is positioning itself to become a serial acquirer within Poland and other European markets.

This strategy aligns well with the business model of Constellation Software, known for its success in growing through a series of strategic, often smaller-scale acquisitions. For investors, Sygnity’s recent activity could be seen as an indication of an accelerated growth phase, leveraging the company’s expertise and market position to acquire and integrate niche software providers in Europe.

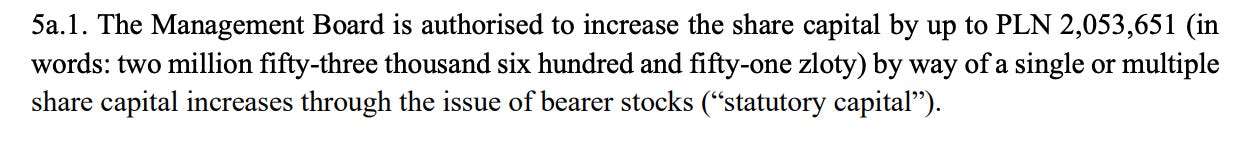

A possible downside is that, in November 2023, Sygnity adopted a resolution to authorize the management board to deprive existing shareholders of their pre-emptive rights to purchase newly issued shares before they are sold to the public. In other words, shareholders won’t be able to avoid dilution of their holdings if management issues new stock to use for acquisitions.

Under this resolution, the Management Board is authorized to increase the share capital by up to 2,053,651 PLN. In practical terms, this could translate to issuing approximately 2.2 million new shares, assuming a nominal value of 1 PLN per share. If used properly, the valuable equity could allow the company to get a prized asset into the company.

Potential for Leverage and Broad Range of Business Units

The shift in Sygnity’s strategy towards acquiring other companies brings into focus the potential for leveraging its financial position. An important aspect of this strategy is the company's ability to take on additional leverage. Given Sygnity’s current financial status, characterized by a healthy cash-to-debt ratio, the company appears well-positioned to increase its leverage.

Leveraging, when used properly, can enable a company to finance acquisitions, invest in growth opportunities, or even improve shareholder returns without necessarily compromising financial stability. Sygnity's strong financial health, evidenced by growing profits, growing revenues, and other key metrics, suggests that it can manage additional debt effectively.

This is where the majority ownership by TSS has both an upside and a potential risk. On the upside, Sygnity can further tap funds, based on the strength of TSS, for M&A. On the downside, there is the potential for a conflict of interest because, if a potential acquisition is especially attractive, TSS could be tempted to buy it directly, thus owning 100% of the acquisition, versus 70+% if acquired through Sygnity.

Sygnity's range of business units highlights the breadth of its market coverage. Each unit caters to a specific sector, offering tailored solutions that meet the unique needs of their respective markets.

Public: This unit focuses on essential public sector needs, encompassing Labor Market, Social Security, and Public products. By offering specialized software solutions in these areas, Sygnity addresses critical functions of government and public administration, streamlining processes and improving efficiency.

This area, however, poses two downsides. First, many of the public clients have recently been including clauses in the contracts specifying that the public client would own the IP. This means that Sygnity does not own the solution, and cannot leverage it by reselling it to other clients. Also, it would be easier for the client to replace Sygnity, since they control the source code. The other downside is that the public business has resulted in litigation, both from competitors who were not awarded the contract, and between Sygnity and clients over change orders, and whether they fall out of the scope of the original contract, thus resulting in extra payment.

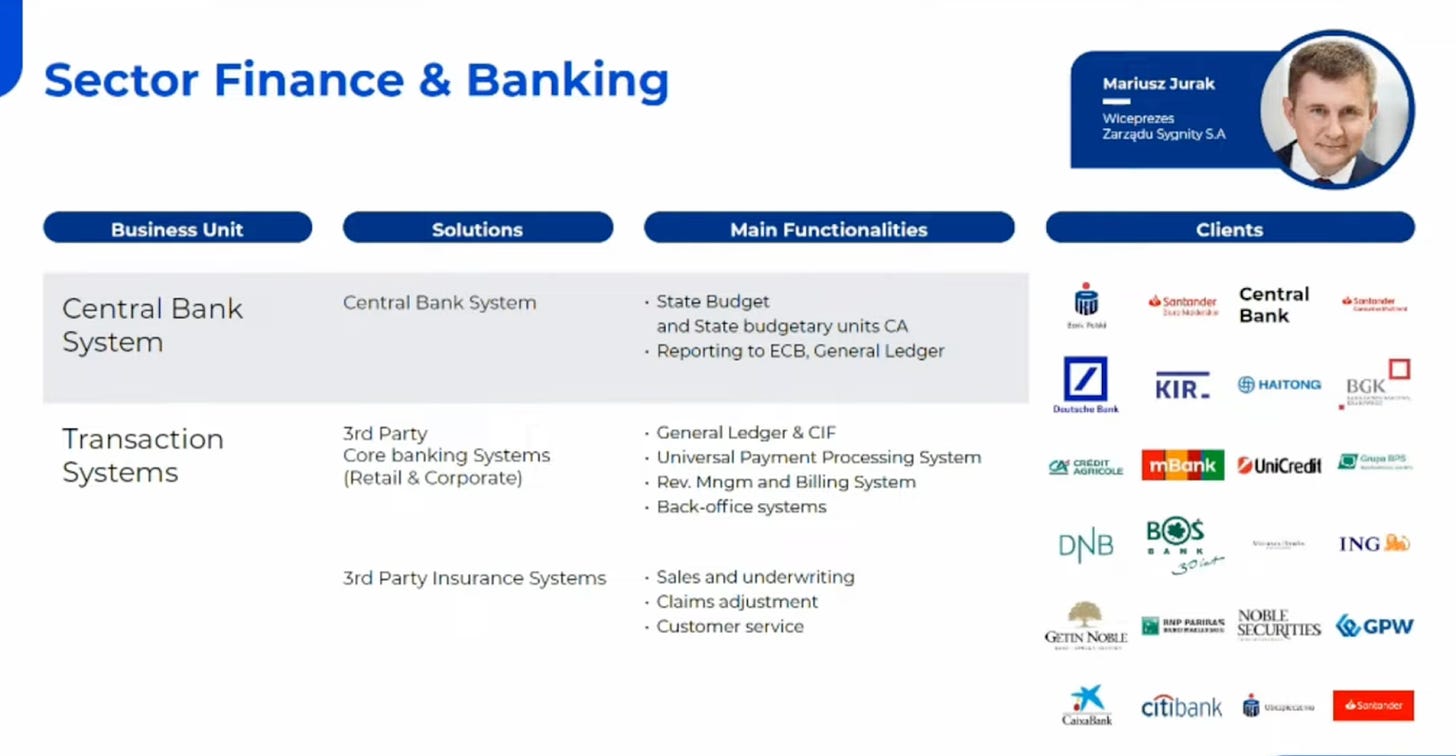

Financial Services: This segment deals with the intricacies of financial systems, including Central Bank Systems, Transaction Systems, Capital Markets, Mandatory Reporting, and Banking Automation. By catering to the financial sector, Sygnity provides solutions crucial for the smooth operation of financial institutions and markets.

This is a bright spot, because a lot of this work consists of customized solutions, where Sygnity owns the source code, so the financial clients are dependent on Sygnity for future, long-term development and support.

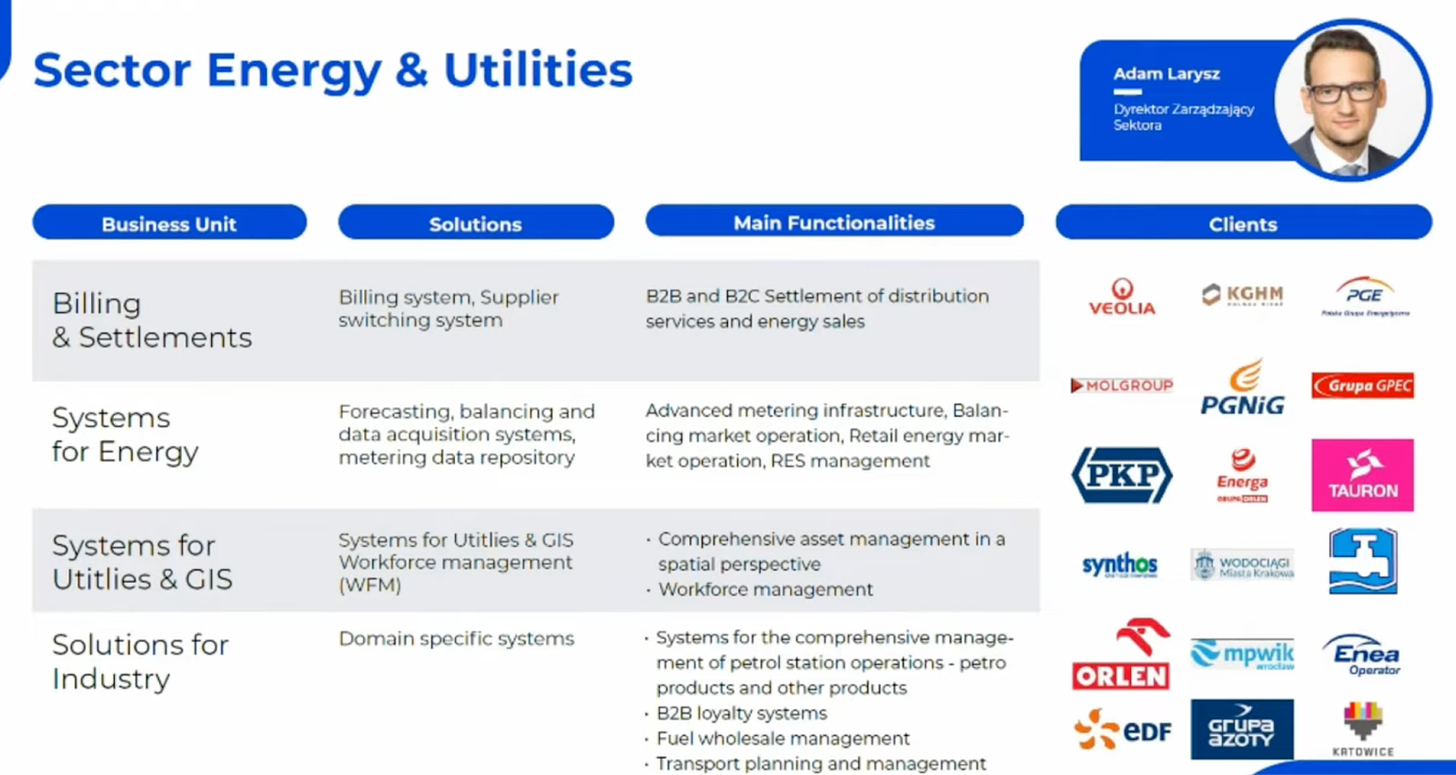

Energy & Utilities: In this unit, Sygnity offers a range of solutions including billing systems, energy management systems, utility solutions, and industry-specific applications. These solutions are tailored to the complex needs of the energy and utilities sectors, helping companies manage resources more efficiently and optimize their operations.

Business Solutions: This unit includes a variety of offerings like Oracle services, Quatra Max ERP, and library management systems. These solutions are designed to streamline business processes, improve operational efficiency, and enhance information management across different industries.

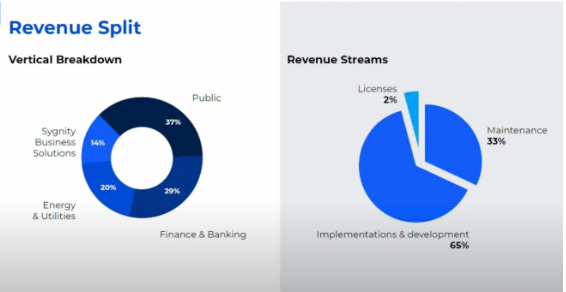

This is the revenue split along with revenue streams

It is interesting to compare the revenue stream split for Sygnity to Constellation. Again, some of what Sygnity classifies as “implementations and development” would fall under “maintenance” for TSS / Constellation.

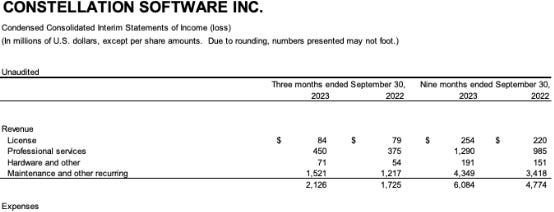

Based on the Q3 numbers, the split can be viewed as:

Sygnity's revenue stream reveals a focus for scalable growth. The company's heavy investment in implementations and development, constituting 65% of its revenue streams, indicates an aggressive growth model, reliant on custom software solutions and system integrations. This approach reflects a commitment to capturing new market segments and expanding their customer base, a strategy that can potentially yield high returns on investment but may require substantial upfront resources and longer sales cycles.

Maintenance "only" accounts for 33% of Sygnity’s revenue, which suggests a reliable and stable income reflective of an established customer base with recurring needs. While not as high as Constellation Software's 72% maintenance and recurring revenue, it points to an opportunity for Sygnity to grow this segment.

Worth noting, despite apparent declines, Sygnity assures that its core maintenance revenue is, in fact, increasing — a positive sign of sustained customer loyalty and an outcome of TSS’s influence in streamlining Sygnity’s financial reporting.

When comparing the two companies' revenue streams, Sygnity appears to be in an earlier growth stage, with a greater emphasis on development and less on professional services. This is indicative of a company that is in the process of building its market presence and customer relationships, rather than relying solely on the annuity-like income that Constellation Software enjoys.

Sygnity’s current revenue streams suggest a company that is investing in its future, one that is actively seeking to enlarge its footprint in the VMS space. By focusing on implementations and development, Sygnity is laying the groundwork for a transition to a more balanced model where recurring revenues can eventually become a stronghold. As Sygnity continues to make strategic acquisitions like Edrana Baltic, it could begin to mirror Constellation Software's revenue mix, balancing the initial costs of implementations with the stable income from maintenance services.

Past Financial “Issues”

Due to a dispute with Fast enterprise ( a subcontractor), they paid 3.75 million USD, and released 36 million PLN of provision. Net Profit was adjusted by 19 million PLN. This occurred during FY21.

More can be read about it here: DT law firm represented Fast Enterprises, LLC in the dispute and settlement with Sygnity S.A. | Kancelaria Drzewiecki Tomaszek i Wspólnicy sp.k.

A tax issue caused by prior management was solved, but for FY22, net profit was impacted 33% due to this.

Strategy

Sygnity’s strategy can be viewed through three prongs: core optimization, selective organic growth, and strategic mergers and acquisitions (M&A).

In the face of Poland's significant inflation, Sygnity is pivoting to adopt industry norms by passing increased costs to customers — a departure from past practices. Previously, many of Sygnity’s contracts were long term, and were agreed to when inflation was lower. This meant that, while costs were increasing, they could not pass them onto the client, thus hurting margins. Now, however, Sygnity is including language in its contracts to allow for automatic price increases, indexed to inflation.

This shift is part of a broader initiative to 'fix the core', which has seen Sygnity taking decisive steps to enhance efficiency. The company has strategically discontinued unprofitable contracts and initiatives, including the eTax and Digital Transformation units in FY22. This streamlined approach is aimed at maintaining Sygnity’s agility and cost-effectiveness in a challenging economic climate.

On the organic growth front, Sygnity is recalibrating its strategy towards public projects, which have become less profitable due to stiff competition and lower-than-anticipated returns. As a result, the company is pivoting towards projects like 'Domain X', seeking to extract incremental growth from existing business lines through focused improvements.

The cornerstone of Sygnity's future growth is its M&A strategy, which targets smaller yet strategic companies within Poland and the adjacent regions. With a dedicated team and a proprietary pipeline modeled after TSS’s proven approach, Sygnity is setting the stage for a significant expansion. This strategy, which includes acquiring horizontal companies with strong VMS fundamentals, is extending Sygnity's reach into key CEE markets, particularly Lithuania and Latvia.

Sygnity’s financial foundation is strong, characterized by substantial cash reserves and a strong potential for leveraging, negating the need for external funding to fuel its M&A activities. This financial independence is particularly advantageous given the rapid growth of Poland's economy relative to Western Europe, which bodes well for Sygnity's prospects of achieving superior organic growth.

Compensation:

Sygnity is adopting a compensation model that mirrors the successful approach of Constellation Software Inc. (CSI), with plans to fully implement this structure across the organization by 2024. This transition begins with the Board in 2023, followed by the broader management team. The rationale behind this model is twofold: to align the interests of employees with the company’s performance and to foster a culture of ownership.

A key aspect of this compensation strategy is the decision to maintain Sygnity as a partially public entity. This approach facilitates a structure where employees can invest a portion of their bonuses into company shares, an incentive that has proven effective within CSI. By allowing employees to become shareholders, Sygnity not only incentivizes performance but also nurtures long-term commitment to the company’s success.

Sygnity acknowledges the challenges posed by the limited float and low liquidity in the context of employee share purchases. The Board is actively seeking solutions, drawing on lessons from the early days of CSI, which faced similar issues. The goal is to ensure that management and staff have the opportunity to participate in the company’s growth through equity ownership without disrupting the market, thereby creating a win-win scenario for the employees and the company alike. It is worth noting that the company announced a 20,000-share buyback for their employees. They have been buying shares every day for about a month now. The details of the exact purchases are available in the Current Reports section of the Investor Relations website.

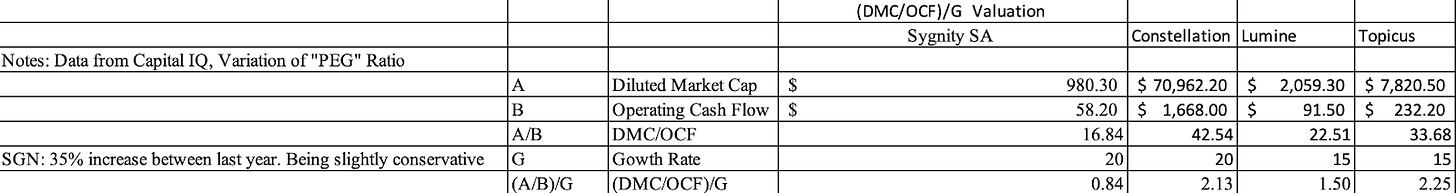

Valuation

The calculated ratio of 0.84 indicates that the company's cash flow growth is outpacing the growth reflected by its current market valuation. This suggests that the company may be undervalued by the market.

This document is provided for informational purposes only. Historical performance is not indicative of future results. This should not be considered financial advice. The author holds a long position in Sygnity, $SGN.WA

Special thanks to CJ, Trevor, and

Thank you very much for this interesting insight! What great people that give this conclusion for free THANK YOU VERY MUCH AGAIN ❤️

Thank you 💚 🥃