Quick Defense ETF Primer: Optimal Pairing and Industry Insights

I plan to release write-ups on Melrose Industries, Leonardo, and possibly Curtiss-Wright (yes, descended from the original Wright Brothers) this summer.

Before that goes live, I want to quickly review the FY 2025 Budget request for the DoD and the major ETFs available for investors.

Additionally, I have provided some quick commentary on those ETFs and recommendations on which pairing to consider.

Budget:

With a 2025 budget request of $849.8 billion for the Department of Defense (DoD), representing over 3% of US GDP, defense companies in the United States are poised to achieve record earnings.

One of the best ways to capitalize on this potential growth is by investing in Aerospace and Defense (A&D) ETFs, which offer exposure to a diversified basket of companies within this sector.

Breaking down Secretary of Defense Lloyd J. Austin III’s statement, the following is requested in the plan:

$167.5 billion in procurement

$147.5 billion to build and maintain our warfighter force and capabilities

$143.2 billion in research, development, test, and evaluation (RDT&E)

$61.2 billion for airpower

$49.2 billion to modernize all three legs of the nuclear triad

$48.1 billion for sea power

$33.7 billion for space capabilities

$28.4 billion to enhance missile-defense capabilities

$19.8 billion to modernize facilities

$17.5 billion for construction and family housing programs

$14.5 billion for cyberspace activities

$13.0 billion for land power

$9.8 billion for long-range fires

$1.3 billion to support the DoD audit

The remainder is allocated to pay increases, infrastructure development, and support for allies.

A full breakdown can be read here: 2025 DoD Budget Request

While individual companies may benefit more than others, holding a basket of stocks through ETFs is one of the safest ways to invest in the defense sector.

It’s also worth noting that many defense companies have significant exposure to commercial aviation, which is a highly profitable sector from a supplier perspective.

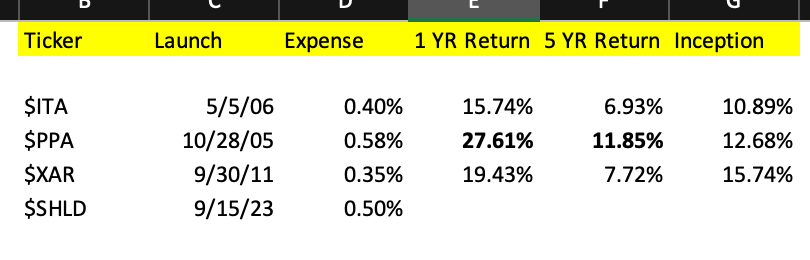

Here is a list of the four largest A&D ETFs available for investors:

ITA 0.00%↑ PPA 0.00%↑ XAR 0.00%↑ and SHLD 0.00%↑

Lets take a closer look at these from a past performance point of the view:

PPA has outperformed both ITA and XAR over the past five years and since inception. While XAR may appear to have strong performance due to its later start date (9/30/2011), a direct comparison between PPA and ITA shows that PPA has returned 15.9% compared to ITA's 13.67% since XAR's inception date.

It's worth noting that SHLD went live less than a year ago. Although the time period is extremely short, it has performed exceptionally well so far (37.18% since inception).

But, in investing, we always say that past performance doesn’t dictate future performance.

ITA:

ITA is very concentrated with 34 holdings. The top 5 represent over 55% of the fund, with the top 10 holdings making up almost 75%.

My thoughts:

I love concentration, but I don’t like that almost 20% is in Raytheon, 13% in Boeing, and 13% in Lockheed Martin. This heavy weighting feels like it could hamper growth. I am appalled that a name like General Electric (GE) is not included. GE is up almost 100% in the past year, and holders of ITA haven’t benefited from it.

It's worth mentioning that over 75% of commercial flights are powered by a GE engine. This is not an unknown company.

Large companies such as Eaton and Parker Hannifin are also not present in this ETF.

Leonardo, the 13th largest defense contractor in the world, and 8th within NATO countries, not being included is a head-scratcher.

Additionally, the absence of names such as SAIC, Parsons, and CACI is odd. These defense services companies have performed exceptionally well over the past decade, are growing steadily, and tend to trade at fairly attractive valuations.

I can’t, in good conscience, recommend ITA. I am fairly surprised that it has so much AUM compared to a name like PPA.

PPA:

With 51 holdings, PPA is significantly less concentrated than ITA. The top 5 holdings represent 30.5% of the fund, while the top 10 make up 53%.

My thoughts:

PPA still holds its largest positions in Raytheon Technologies and Lockheed Martin, but not to the extent that ITA does.

It's great to see General Electric and Eaton near the top of the list. Additionally, I like that over 10% is allocated to professional services firms that derive a large portion of their revenue from the defense sector. As mentioned earlier, this is a good sub-sector of defense to be in.

While PPA holds most of the names that ITA does, the reverse is not true.

I would be disappointed to be a holder of ITA. I think there is a clear reason why PPA has significantly outperformed in the past and will likely continue to outperform in the future.

XAR:

With 33 holdings, the top 5 represent 22% of the fund, and the top 10 holdings account for close to 45%.

My thoughts:

XAR is quite interesting. It is essentially ITA but with less exposure to Raytheon, Boeing, and Lockheed Martin, and more allocation given to every other company. The individual holdings are almost completely the same, with a 96.8% overlap with ITA.

I feel like one holds ITA because they want direct exposure to the largest defense names, or they hold PPA because they want the best overall exposure to the A&D space. XAR fits somewhere in between these two.

SHLD:

SHLD is very concentrated with 35 holdings. The top 5 represent almost 40% of the fund, while the top 10 make up almost 75%.

My thoughts:

This is a more worldwide defense ETF. While your largest holdings are the American contractors, adding in BAE Systems, Rheinmetall, and Saab, for example, is great. However, in order to maintain this concentration while including foreign defense names, you miss out on extremely good American companies such as TransDigm, GE, and Curtiss-Wright. I think this is a great ETF for international defense exposure, but the concentration means some high-quality American companies are excluded.

In my opinion, going long on European defense is going to be an excellent theme for the next few years.

Hence the Leonardo write up coming soon.

With no international defense ETFs available for Americans to buy, I think if you don’t want to hold individual names, then this is an excellent option that pairs perfectly with another defense ETF.

Conclusion:

I firmly believe that PPA will continue to outperform ITA for another decade or more. I'm disappointed in the names that ITA leaves out, and I think that high concentration in names that may not outperform the smaller companies will continue to drag on its performance, as it has done since inception.

PPA has more exposure to faster-growing sectors while still maintaining a proper balance in the largest American defense contractors. The additional 17 companies allow investors to reap the benefits of more companies that supply parts and participate in the defense market in other ways.

However, the lack of international exposure will probably limit PPA's potential in the future.

That's why SHLD is the perfect complement. While lacking exposure to American names poised to benefit the most from the budget request may hamper its future performance, being long on more international companies means that the ETF will allow investors to benefit from global defense spending in light of existing threats. Europe has been asleep for decades under American watch, but it's clear that it's slowly waking up.

XAR is just a cross between PPA and ITA. I don’t see the point in holding it.

Thus, I believe PPA and SHLD are the perfect combination for an investor wanting to hold a diversified basket of A&D stocks.

Moving Forward

As mentioned, I plan on releasing a more in-depth look at Melrose Industries, Leonardo, and Curtiss-Wright ( CW 0.00%↑ )

I am very bullish on the A&D sector and continue to believe that this area will perform well in the coming future.

I’m also in the later stages of buying a small aerospace distribution business, which is exciting (to me, at least!) This has also been a leading reason why written content has been slow to get out.

This document is provided for informational purposes only. Past performance is not indicative of future results. This should not be considered financial advice. The author does not hold any of the ETFs written above. The author is a shareholder of General Electric, Melrose Industries and Curtiss-Wright which are mentioned in the article.