First Athene, then AEL - Now FG?

A previously covered insurer is trading well below book and might not stay public for long

This summer, FG 0.00%↑ will become eligible to be sold. Recent transactions validate a 25–30% upside. The stock has recently pulled back following a share issuance to fund further growth. Until that overhang clears, I expect it to remain range bound around the $35 level which I view as an attractive entry point to accumulate shares.

I’ll keep this post straightforward, but if you’re unfamiliar with the company, refer to my short write-up from December 2023 as a primer.

As a quick TLDR:

“After June 1, 2025 (five years of ownership), FNF 0.00%↑ will be able to spin off the rest of FG to its shareholders tax free. This move is expected to make FG an attractive acquisition target, as it would be the last pure-play fixed annuity provider in the market”

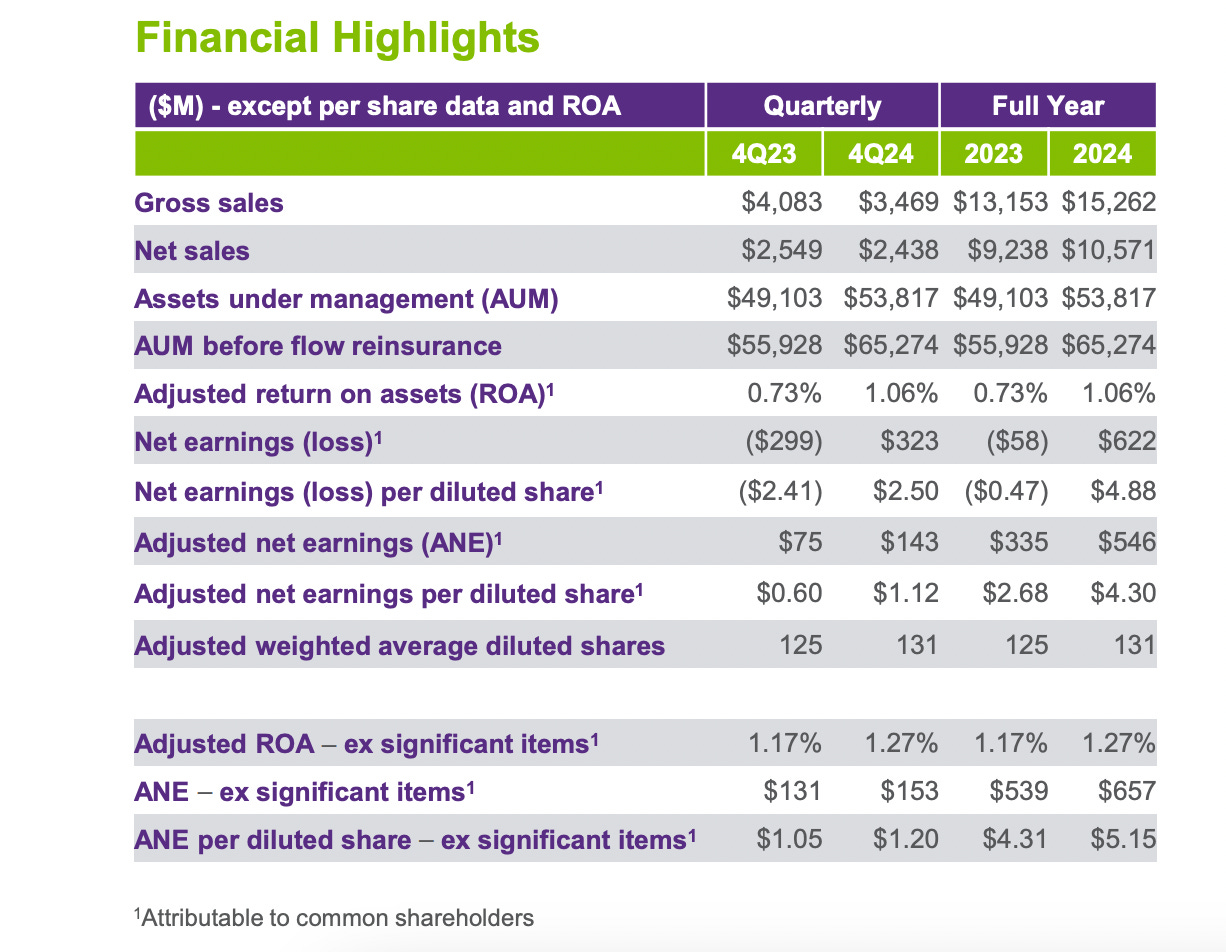

Their Q4 Financial Supplement and Winter IR Presentation are also excellent places to understand the numbers for the company and learn about it.

But if you don’t want to go through that, here’s a quick highlight of some headline numbers for the company:

The Equity Raise

On March 24th FG completed a public offering of 8m shares at $35, raising $280m to fund further growth. Underwriters also have a 30 day option to buy an additional 1.2m shares, which could add $42m more. This dilution, combined with uncertainty around the underwriters’ decision, has driven a drop in the stock price.

That said, FNF bought 4.5m shares from the underwriters at a discounted $33.60 per share, totaling $150m. To me, this is significant as it shows FNF remains confident in FG and eager to keep fueling its growth. Less than 18 months ago, they injected $250m so another $150 million isn’t pocket change. It’s a strong vote of support amid the dilution noise.

Take Out Valuation

As of December 31 2024, FG’s book value excluding AOCI was $44.28, while the stock currently trades at $35.10, implying a valuation of 0.79x BV ex-AOCI.

If and when FG is acquired, I believe it will be at 1.0x or $44.28 per share. At the current price of $35.10 that represents an upside of approximately 26%.

The semi recent Apollo & Athene transaction comps favorable:

On March 8th 2021, APO 0.00%↑ and Athene merged in an all stock transaction.

Q4 2020 BV ex-AOCI was $56.95 and the stock traded was trading at 0.86 P/B ratio.

The deal implied an equity value of approximately $11 billion, or 1.0x bv. This is verifiable through the S-4 filing, which shows 193m shares outstanding and a per share valuation of $56.95, resulting in $10.99 billion in total equity value.

The Brookfield & AEL sale about two years ago also helps:

On June 23rd 2023 BN 0.00%↑ bought the remaining 79.62% of American Equity Investment Life (AEL) that it did not own for about $4.3B or $55 per share. They used cash + Brookfield Asset Management BAM 0.00%↑ equity to buy the company.

Prior to the deal, AEL traded at $41.20, or 0.65x bv. AEL’s Q1 2023 bv ex-AOCI was $63.56, implying a take out multiple of 0.87x.

There was also a more conservative measure of bv (excluding AOCI and the fair value accounting for fixed index annuities), which came out to $38.05 per share. Based on that figure, AEL was trading at 1.08x bv before the deal and was acquired at 1.44x. However, for consistency with other comps, I’m using the standard bv ex-AOCI figure of $63.56.

I think 1.0x BV is still a fair assumption though.

CEO Christopher Blunt has bought over $800k worth of shares on the open market this past week.

I own most of my FG shares in my Roth IRA since I view this as a relatively short term opportunity. With the most likely upside in the 25–26% range, it probably doesn’t make sense to take a tax hit in a regular brokerage account.

Risks:

Outside of a broader market meltdown or something going structurally wrong in the insurance space (CLOs blowing up, major credit losses, etc.), I think one under-discussed risk is that FG is performing so well that FNF might not want to spin them out.

Back during the Q2 call for FNF I noticed the following exchange:

Hey and good afternoon. You’re about one year at from potentially being able to spin out F&G. So just any updated thoughts on what you guys might do?

Tony Park

Yes, Bose. Thanks. This is Tony and Mike might weigh in as well. But as we’ve said in prior quarters, the Board has been very pleased with F&G’s performance and the validation of the thesis behind the acquisition, which has been a real complement to the Title business, as you probably heard us say, 40% of our adjusted net earnings in the first half were generated by F&G. With a strong leadership team, a strong company there.

And frankly, it's outperformed even probably our best or highest expectations. And so at this point, I think, I mean there's optionality out there. You've seen us do deals in the past. But at this point, like I said, the Board is very pleased about F&G's performance. And I would say it's been other than the last few days, I think it's been recognized in the share price in both of our share prices and it's been a positive experience so far.

Got it. Okay. And then it looks like F&G's contribution this quarter to EPS exceeded at least what title generated on a core basis, I mean this is the first time, and this kind of place your whole thesis, right, of being able to offset title earnings in a tough environment. So I guess, does this sort of performance maybe embolden you and the management team to just stay the course on F&G? Or are there other factors that we should think about when it comes to sort of owning the asset longer term?

Anthony Park

Yes. It's a fair question. I think we've been saying for a while that staying the course is exactly what the board intends to do at least for now. We can't predict the future, and what might happen and if there's a better opportunity, we've been opportunistic over our history with various businesses, and so you can't predict what might happen there. But I will tell you, the board is very pleased with F&G's performance.

When I first bought shares back in mid 2023 the thesis was simple: the stock was trading around 0.5–0.6x bv, and I expected it to re-rate closer to 1.0x. That happened relatively quickly (within 6–8 months). But now it is under book again.

From a pure operating perspective, the company continues to execute really well but I don’t think there’s that much upside left without a takeout.

It’s up to you to decide whether - 25% upside, with no clear timeline, is worth it.

Some Sources:

https://ir.athene.com/sec-filings/all-sec-filings/content/0001527469-22-000018/ahl-20211231.htm

https://www.apollo.com/insights-news/pressreleases/2021/03/apollo-and-athene-to-merge-in-all-stock-transaction-120032339#:~:text=NEW%20YORK%20and%20HAMILTON%2C%20Bermuda,approximately%20%2411%20billion%20for%20Athene.

https://d1io3yog0oux5.cloudfront.net/_dea3b227f79ea64e74c7d1fb9e47d39a/athene/db/2271/21940/pdf/APO-ATH-Merger-Presentation-3.8.21.pdf

https://www.businesswire.com/news/home/20230508005633/en/American-Equity-Reports-Strong-Earnings-Driven-by-Ramping-Private-Asset-Allocation-to-24-while-Growing-Total-Sales-to-%241.4-Billion

https://s1.q4cdn.com/478245285/files/doc_financials/2024/q4/FG-Winter-2024-Investor-Presentation_F.pdf

https://s1.q4cdn.com/478245285/files/doc_financials/2024/q4/Q4-2024-Financial-Supplement_F.pdf

This document is provided for informational purposes only. Historical performance is not indicative of future results and nothing in this post should be considered financial advice. The author holds a long position in FG Annuities & Life and Apollo. The views expressed are the author’s alone and do not reflect the views of any current or past employers.

Special thanks to “Yerd” and

for the help with editing and thoughts.